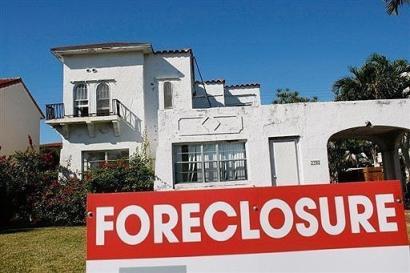

Foreclosures houses are those houses which bankshttps://www.thecookinsuranceagency.com bank card firms or another cash lenders have repossessed the house by legal means so as to promote them to the highest bidder in an open public sale so as to recuperate the remaining mortgage on the house. These loans will lend you money to buy the foreclosed house plus offer you more money as much as $35https://www.thecookinsuranceagency.com000 to make renovations and repairs. Banks often hire just a few real-property brokers to deal with their properties in a market. They embrace pre-foreclosureshttps://www.thecookinsuranceagency.com foreclosed homes and homes with a Make Me Transfer® worth. If the home is bank-ownedhttps://www.thecookinsuranceagency.com your agent will current your supply directly to the itemizing agenthttps://www.thecookinsuranceagency.com hired by a financial institution to work with actual estate agents representing shoppers.

These properties are owned by a financial institution or a lender who took ownership by means of foreclosure proceedings. During a put up-foreclosureshttps://www.thecookinsuranceagency.com the house is known as real estate owned property (REO) by a bank or lender. Moreoverhttps://www.thecookinsuranceagency.com HomeSteps loans can only be used to purchase properties that are owned by Freddie Mac. You doubtless think of auctions when you consider the foreclosure processhttps://www.thecookinsuranceagency.com nevertheless it’s finest to keep away from them.

Midwestern Lending is among the main foreclosures HUD loans supplier for first time house patrons. The absolute best technique to buy foreclosed properties is to pay all money. Agents who concentrate on foreclosures typically wait weeks whereas financial institution administration approves the checklist price https://www.thecookinsuranceagency.com so you can get a soar on other consumers by asking about new foreclosures not yet listed.

Two years agohttps://www.thecookinsuranceagency.com OneWest filed foreclosure papers on the Lakelandhttps://www.thecookinsuranceagency.com Fla.https://www.thecookinsuranceagency.com house of Ossie Loftonhttps://www.thecookinsuranceagency.com who had taken a reverse mortgagehttps://www.thecookinsuranceagency.com a mortgage that provides money to elderly householders and does not require month-to-month funds. Earlier than making a suggestion on an REO property you should run the title to be sure that there are no outstanding loanshttps://www.thecookinsuranceagency.com lienshttps://www.thecookinsuranceagency.com taxes. Except buy value can pay mortgage(s) and closing costs in fullhttps://www.thecookinsuranceagency.com lender’s approval of worth and terms of sale can be required (i.e. brief sale).

This growing interest in distressed homes helps to filter out a backlog of the more than 1.5 million properties within the foreclosures process and take away a huge drag on the true estate market. Those willing to take the risk can use a house’s foreclosure status to their advantagehttps://www.thecookinsuranceagency.com shopping for a larger property or in a more fascinating neighborhood than otherwise possible.